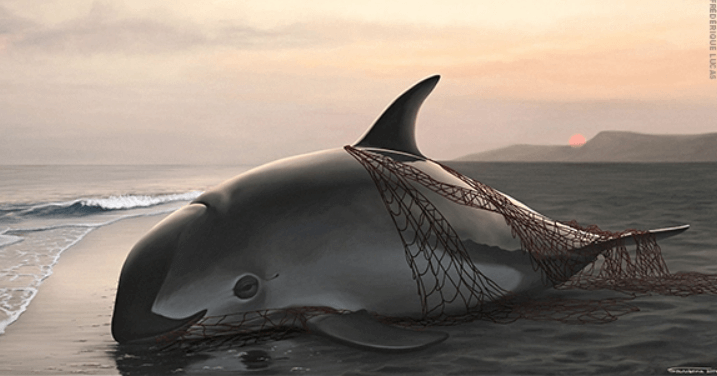

The recent crypto market crash has the markings of the 2008 Global Financial Crisis and had FTX fallout written all over it.

So, what role did FTX have in the 2022 crypto crash?

FTX’s bankruptcy, following a spat with Binance, resulted in a massive sell-off. This sliced the lion’s share off the cryptocurrency market liquidity. The consequences were dire. But what happened with FTX?

While the buyout of FTX was all set, Binance chose to walk away from the deal. This stunned the investors and caused one of the biggest crypto market stumbles. The failed deal led to a high level of skepticism and distrust in the market as questions about the survival of other cryptocurrency businesses amplified.

FTX’s bankruptcy filing resulted in many investors having their assets frozen. According to The U.S. Commodities Futures Trading Commission (CFTC), the missing FTX customer funds are over $8 billion.

So, is the crypto winter just a temporary setback, or is it the beginning of the end of digital currencies?

Experts believe the crypto market is here to stay and is expected to evolve and eventually adapt in the coming years. But it’s not going to be easy.

So, what’s next for crypto?

The State of the Crypto Market Today

The 2022’s crypto winter that saw the collapse of the crypto exchange FTX seems to be easing out, with top digital currencies delivering more gains in February. Bitcoin enjoyed a 1.3% monthly gain, and Ethereum (ETH) leaped to 3.7% in February.

So, does that mean it’s time to throw your hat in the ring? Experts recommend a cautious approach with a keen eye on the financial data.

Despite the good February showing, investors are still worried about growing Federal Reserve interest rates and inflation. While we cannot predict the future, the recent trends in the digital currency market suggest a recovery.

Potential Regulatory Changes and Their Impact

Regulatory changes are a big unknown for the crypto market, as the impacts could go either way.

You see, market regulation has been picking up speed in the major markets, with the U.S. and China markets experiencing heightened scrutiny. The views are a mixed bag.

Some see more crypto market regulation as bringing greater legitimacy and encouraging broad adoption. A section of the experts believes the market’s survival depends solely on regulation and governance. But others see it as a shot in the arm.

The U.S. Securities and Exchange Commission (SEC) crackdowns on initial coin offerings (ICOs) and cryptocurrency exchanges have been on steroids. For instance, the New York Department of Financial Services forced Paxos Trust to stop generating more BUSD tokens. There are also reports of SEC plans to sue Paxos for breach of investor protection laws.

Binance is anticipating fines for various violations, such as the breach of the anti-money laundering laws. Due to increased scrutiny, Binance has been hemorrhaging customers, and investors are worried about its health. It’s not a surprise that some expect the exchange to follow in the footsteps of FTX. Meanwhile, Kraken agreed to fork out a $30 million SEC fine and exit the U.S. crypto staking service market. This begs the question, is the U.S. government bent on doing away with the cryptocurrency market?

But it’s not U.S. alone; the Chinese government has been doing its own crackdowns on the cryptocurrency market.

China has adopted a hardline stance on digital currencies by cracking down on crypto trading and banning initial coin offerings.

The thing is, the real impact of future regulatory changes will be based on how they are implemented.

The Role of Institutional Investors in the Future of Crypto

The growth of the crypto market has primarily been on the back of institutional investors. Other large investors have been allocating funds to the market, from pensions to hedge funds. The impact has been significant.

Institutional investors bring greater stability and liquidity to the market, encouraging greater adoption and helping mitigate volatility.

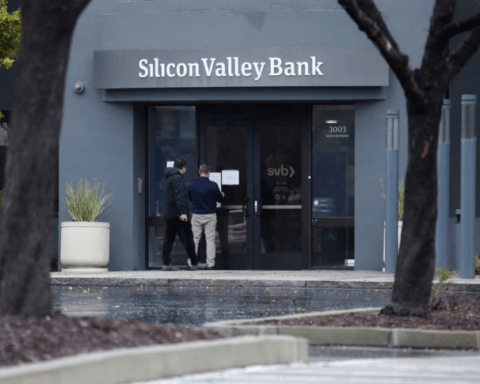

The Signature Bank (SBNY) loss has dealt a significant blow to Binance. Combined with growing scrutiny by the government, investors are becoming worried.

The Importance of Adoption and Accessibility

Lack of adoption and accessibility has been a thorn in the flesh of the crypto market. It has been one of its biggest challenges. If more people don’t use the currency, then it becomes useless.

While wide adoption has proved a stubborn hurdle, cryptocurrency tech has grown significantly in recent years. Certainly, accessibility is still not where it should be.

Addressing adoption and accessibility will be the key to the growth of digital currencies. But it’ll require a concerted effort from the governments, regulators, and industry participants.

The Future of Cryptocurrencies: Challenges and Opportunities

The crystal ball shows complex challenges for the cryptocurrency market, and increased regulation is among the most potent. But there’s also a silver lining.

The latest launch of the Ethereum Layer 2 (L2) network dubbed ‘Base,’ is an attempt by Coinbase to scale the Ethereum network. The L2 builds on top of the main Ethereum blockchain for security and user-friendliness. Such developments could usher in an era of widespread adoption and accessibility.

But despite the strong showing in February, analysts expect crypto to struggle throughout the rest of the year. There may be additional rate hikes that further depress the market.

As it stands, government regulations are crypto’s biggest challenge.

There’s a need for regulators and industry participants to collaborate to establish an environment that encourages innovation.

What lessons can we learn from the crypto winter?

The cryptocurrency crash has busted the myth of bitcoin as a hedge against inflation. If anything, the crypto market movement has synchronized with the stock market. The two financial markets have been moving in the same direction. This means that tighter monetary policy and high inflation have affected crypto investors in the same way as stock market investors. These factors had a hand in the crypto crash of 2022.

So, is it safe to invest in cryptocurrency in 2023?

Post-FTX crisis, investing in something you’ve thoroughly researched and understand is recommended. As a rule of thumb: invest in something you comprehensively understand and avoid crowd mentality. Don’t forget to diversify your portfolio – don’t put all your eggs in one basket.

Andrew Gichaga

An automotive writer. A wordsmith and a gearhead with a passion for cars that spans decades, I find immense pleasure in creating and consuming content about all things automotive.

Whether I’m writing about the latest tech, exploring the history of classic models, or sharing my own experiences behind the wheel, I strive to craft engaging, informative pieces that inspire and inform.