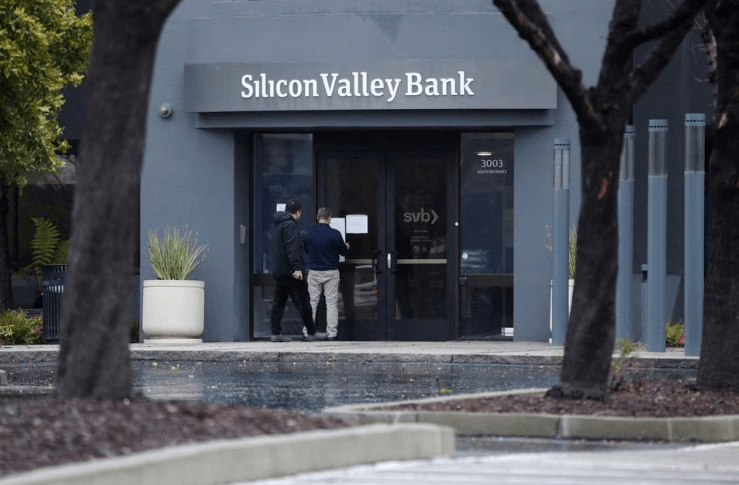

Money and Banking is a required economics course in most business colleges. Banks were a large problem with the Great Depression (1929 to 1938 to those of you who didn’t pay attention in history class). There was a great economic downturn again in 2008,or, as it is called, “The Great Recession.” Fast forward to 2023, and the sixteenth largest bank in the U.S., the Silicon Valley Bank failed, (from here on referred to as SVB) with a considerable amount of help from Twitter, which influenced a great number of depositors to withdraw their money from SVB. The Silicon Valley millionaires have great belief in their inventions, but apparently little belief in the bank that helped them get wealthy. According to The Wall Street Journal of March 17, 2023: “It is now apparent that the ruination of this 40-year-old institution was, in a sense, an inside job, initiated by the very startups and investors who had previously been so devoted to it.”

Let’s be clear, for those of you who do not understand what banks do; banks do not keep all of your money in a vault. Banks give out loans, based on your credit rating, the miscreant that hinders your ability to borrow the money you need to buy things. Banks distribute your deposits among various investments, in order to generate income. There is not a bank anywhere that has all of the money that its depositors put into it at any given time. When depositors all walk into the bank and ask for their money back, it is called a “run” on the bank. Please understand that I am not criticizing banks for not having all of the depositors’ money in their vault, it is simply not the way banks operate. Should your bank fail due to bad investments, your money is guaranteed by the FDIC, aka the Federal Deposit Insurance Corporation, a government entity that insures your deposit for up to $250,000.00, and a lot more than that if you ask President Biden.

SVB’s problem(at least one of them) was that it invested its depositors’ money in ten-year financial instruments, that meant that it could not cash out those instruments for ten years, and, as fate would have it, that was a bad choice. I would suggest that another one of SVB’s problem was that too many of its depositors were on (and believed in) Twitter, but I am not sure if a bank can ask you that question when you open an account. SVB was a major player in the startups of Silicon Valley California, the heart of startups and instant millionaires who come up with great high-tech solutions to problems that you never realized that you had, like writing that term paper for you instead of you having to sit down and write it.

Another recent bank failure was Signature Bank, based in New York. Signature Bank allowed deposits in Bitcoin, that specious investment that allows “first adopters” to lose most of their money because Bitcoin is just some electrons in a circuit, based upon nothing of any value except the belief of some greedy nerds who expect this new cryptocurrency to make them wealthy. Go to any bank you can find and try to deposit something you believe will have value, and you will get laughed out of there.

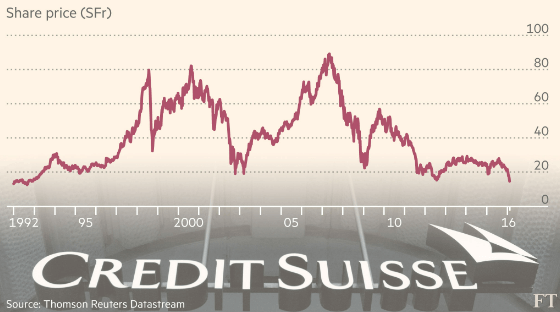

Credit Suisse, a “global investment bank and financial services firm founded and based in Switzerland” posted a loss of $7.9 billion, and its stock plummeted the week of March 17. Not to worry, Union Bank of Switzerland agreed to buy Credit Suisse for $3.25 billion to “calm turmoil.” In case you weren’t aware of it, the Swiss bankers, known for their tight lips about clientele, will not join the European Union because to join the EU would mean that the banks would have to open their books and see just who are their customers, and that would not work for the Swiss, since many of their customers are European drug dealers who launder their profits with the aid of the tight-lipped Swiss bankers. “It’s not personal, Sonny, it’s just business.”

The Swiss bankers are, and will be, awash with cash, some deposited decades ago by Holocaust victims who never returned with that five-digit account number, so it stayed in the banks. To be fair, the Swiss banks have paid $183 billion to Holocaust survivors, but it took decades for that to happen. No doubt there are many U.S. citizens who wish banks of the U.S. were as tight-lipped as the Swiss banks have been. Someone’s gotta do it.

The Fed, the U.S. Federal Reserve, put off raising interest rates until inflation hit nine percent, and then eagerly began boosting interest rates to cut the inflation. For those of you who didn’t take economics classes, inflation is too much money chasing too few goods. Yeah, about that notion of too much money thing: According to U.S. News and World Report, in 2022, the average 401(k) went from $126,100 to $97,200, a drop of 22%. I am certainly no economist, but it would seem to me that a 22% drop in those 401(k)s would mean that there is 22% less cash in the U.S. economy.

There are those who insist that 401(k)s are not part of the cash in circulation. But to claim that no one taps their 401(k) occasionally, like when prices rise to help ends meet (as in now) would be unrealistic. So, inflation is too much money in the market, and our dear Fed has caused a 22% reduction in that cash out there, or at least in the 401(k)s. If it’s not there, it can’t be spent, right? That said, it seems that the Fed will be raising interest rates by 25 basis points on March 22 of 2023, so it seems that a 22% drop in the currency out there in the economy is just not enough. More pain to come.

The solution is not to walk into your bank and ask for all of your money; they have it. If they don’t immediately have it, the government will print it, guaranteed. The solution is certainly not to print more money, because printing more money will only propel inflation into overdrive, something we really don’t need just now. The U.S. doesn’t need a “run on the banks” and doesn’t need to turn on the presses and create more money. But remember the two most important factors driving the money markets: fear and greed.